Engagement & Retention project | Vamaship

About Vamaship

What is Vamaship?

Vamaship is a B2B SaaS platform - a logistics aggregator - that allows sellers to book their orders with various delivery partners.

Vamaship is in the process of positioning itself as the RTO experts in the industry.

VAS include NDR flows & instant COD - where we reduce RTO rates and provide COD disbursal on the day of delivery.

Why is Vamaship used?

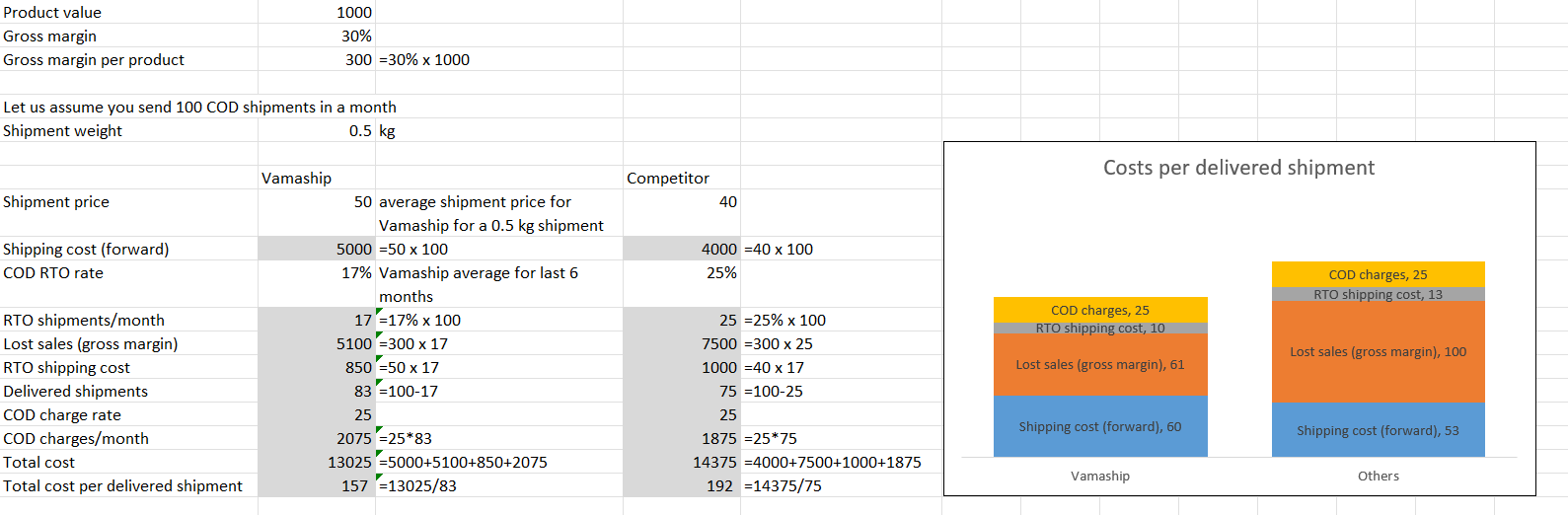

There are quite a few aggregators in the market. A user also has the option of booking directly with a delivery partner. Then why do our customers ship with us? Customers get superior pincode coverage and pricing discounts when dealing with aggregators. And Vamaship does better than competitors at lowering RTO (Return-to-origin). The cost of this is a higher pricing compared to other aggregators (still lower than with delivery partners). So there's a sweet spot where customers use Vamaship.

PS: RTO (Return-to-origin) is when a shipment (mostly COD shipments) does not reach the consignee, and thus must travel back to the seller. This means, the seller does not get any money; plus they have to pay for 2-way transport.

The CVP is "Profitable, convenient & reliable order fulfillment"

When is Vamaship used?

A seller (i.e. Vamaship's customer) books shipments as and when orders arrive. No orders, no shipments. Our casual users receive few orders - it doesn't merit opening Vamaship platform more than once a week. Our core and power users receive sufficient orders, but there is no point in opening the platform more than once a day. Shipments are picked up on a pickup cutoff timing (if shipments are booked before 11 am, the shipment is picked up that day). That said, many of our users are also using competitor's offering. So they split their shipment volumes.

About the Customer

ICP 1 - ecom companies

Meet Anjali. She leads logistics at an e-com company, often with up to 25 others in the company. Her company is usually bootstrapped (or just getting funding), and is usually in the pre PMF to early scaling phases. She is responsible for logistics costs and delivery rate, and is the primary influencer when considering how deliveries are to be made The company's owner is the decision maker, and decides - which partner/aggregators to use, what packaging is to be used, etc. In a few cases, when her company is funded, often, the VC may have a say as to the shipping partner to be used. She gets 10-100 orders per day, from a variety of pincodes. Each day, her team books shipments and hands them to the delivery partner. Each day, she responds to queries from customers; enquiring where their orders are. The ground reality of delivery in India is one where a combination of a lack of transparency and a lack of accountability ("shipment will reach when it reaches") - and this makes her life very difficult. She spends most of her day on call, or on email - co-ordinating with various folks. Her CEO is often upset at her when deliveries don't happen on time - as brand value gets eroded. She uses a basic office setup - a computer, a printer (for printing labels), a personal mobile phone - has to manage inventory on Shopify/Woocommerce, etc, and uses Whatsapp to interact with customers. This segment forms the bulk of our ICP by revenue, and as such, will be the primary ICP considered for analysis.

ICP 2 - Social sellers

Vikram, however, is a social seller. He usually operates alone, and sells products on instagram & facebook. He is often talking to customers, and can garner 1-2 orders in a day. Upon receiving the order, he has to manually enter his shipment details to book the shipment. After creating content, he seeks that his profits not be eroded by logistics costs.

Casual, Core & Power users

User Type | Casual | Core | Power |

|---|---|---|---|

Usage Characteristics | Uses quick ship for convenience in booking a shipment, refills wallet at the last step to keep wallet balance close to 0. | Uses bulk uploads for convenience (no channels used). Books shipments at random timing. Splits volumes across aggregators, looking for a good aggregator. | Customers often split their orders across shipping aggregators depending on region (where there's a risk of non-delivery, they pick Vamaship). Books shipments just before 11 am pickup cutoff |

Recency of use case | This week | Today | Today |

Natural Frequency | 2-3 times a week | Daily | Daily |

Commission Generated towards Vamaship | Rs 50 / month | Rs 1,000-2,000 / month | Rs 5,000-10,000 / month |

Pain Points | Infrequent use means the customers need a simple, conversational workflow | Wants to spend more time growing her own business than get sidetracked on logistics | Needs high responsiveness when shipments are undelivered. Needs more complexity in the form of consolidated reports |

Valued Features | Quick ship (ship a single shipment by adding details manually), tracking sms/mail | Bulk upload (upload all orders in an excel to book shipments), tracking sms/mail | Channel integration (fetches orders directly from website), consolidated monthly reports, NDR services, shipping on credit |

Core Value Proposition |

| Profitable, convenient & reliable (i.e. low returns) order fulfillments | Profitable, convenient & reliable (i.e. low returns) order fulfillment |

JTBD of the persona | Ship products cheap | Ship products conveniently | Ship products profitably |

Discovery | Google search ("Shipping aggregator", etc), referral, ads | email marketing, referral, Google search, word of mouth | email marketing, referral, Google search, word of mouth |

Level of Engagement | Low. User does not experience the value prop sufficiently. | Medium. Splits a large part of their shipment volumes | High. Forms a bulk of Vamaship's revenue. |

Engagement & Retention metrics

An active user is one who has booked at least 1 shipment in a month. While the CVP is realised when shipments are delivered, that takes another few days - shipment booking is a leading metric. Shipment delivery itself is out of the seller's hands (for the most part). It's similar to Amazon's order placement vs order delivery.

So our retention curve currently looks like this

Engagement strategy

There is one main product - order fulfillment. We do sell NDR services and instant COD as Value-added services. These services do improve the value of order fulfillment to the user (in fact, that's the main purpose of these VAS, in addition to improving consumer experience).

Many of our larger customers split their load across Vamaship and competitors. Reasons for this include pricing (for which they pick Shiprocket or directly with logistics partner in some cases) and service quality (for which they pick Vamaship). Depth strategies are likely to work here.

Our casual users rely more on convenience; and they're perhaps the only user type where a frequency campaign might work.

Engagement Framework | Relevance | Key Metric to be tracked | Rationale |

|---|---|---|---|

Breadth | Secondary | Customers using NDR services, Customers using instant COD services | This is potentially good as it generates value through synergy. |

Depth | Primary | Shipments booked per day | Many of our customers split shipment volumes across competitors. |

Frequency | Tertiary | No of days where shipments are booked, | Most of our customers already book shipments once a day. There is no point to booking shipments more frequently. |

Engagement campaigns

For all Core and Power users, there is a dedicated account manager. This account manager frequently connects with decision makers and influencers regularly via call. Customer is also receptive of emails. As such, for all campaigns to Core and Power users, distribution channel is always email/call. For all campaigns to casual users, distribution channel is usually email or in-app banner/pop-up.

- Time based connects (equivalent to Zomato sending push notifications at lunchtime):

- This campaign is targeted at core users, trying to convert them into power users.

- There is an interesting nuance about the logistics industry - the shipments booked before 11 am (pickup cutoff time) get picked up the same day; shipments booked after that would get picked up the next day. Yes, even if the pickup agent arrives at 5 pm, he cannot pick up shipments that are not designated for pickup that day. This means, orders that aren't booked into shipments by 11 straight away get a delay of 1 day. Even a single day of delay causes about 2% chance of increased RTO. Power users are aware about this, and usually book their shipments just before 11 am. The hypothesis here is that getting the customer to experience the CVP will cause them to not split their loads (it's a depth campaign). We're relying on reciprocity bias here - which is why the campaign must be manual.

- We can track which customer has not created a shipment by 11, and call/whatsapp customers about their orders (all core users receive an account manager from Vamaship side; and some partners have different pickup cut-off - up to 12:30). Pitch: Book shipment now, to improve delivery rates

- There is no monetary value credited to the customer in this campaign. The campaign will run on a daily basis; but only to select customers - who have not yet built the "best practices" as a muscle.

- Eventually, we'd expect to see the shipments per month increasing for our core users, and we'd expect to see churn going down. And they become closer to being power users. As we expect to see this happening immediately, milestoning is unnecessary.

- Target feature: Shipment booking by bulk / manage orders

- Referral campaigns

- This campaign is targeted at power users, to get them to refer other customers.

- This should in theory (i.e. needs experimentation) stop splitting their shipment volumes through Commitment & Consistency bias ("I'm referring them, so they must be good for me"). Thus, it's a depth campaign.

- The referral campaign was communicated by mail and orally during account manager's conversations (it happened recently).

- Campaign is currently about 5 shipments free (Rs 250 in platform currency) per successful referral (i.e. referee does 5 shipments in first month). We started it recently, so results (and feedback) are awaited. Pitch: Refer a friend, help them grow their business - and get free shipments for it

- For now, we're experimenting. As such, we've limited it till Navratri. Plan is to send 3 emailers (one sent) and communicate verbally.

- Eventually, we'd expect to see shipments per month increasing for our power users.

- Target feature: Referrals

- Subscription campaigns / VAS bundling

- This campaign is targeted at core and power users, to improve their depth. Each customer will get a custom plan. The plan involves an upfront subscription cost, which reduces their per-shipment costs. If they stay at current volumes, there will be a small gain to the seller. However, as their shipment volume increases, the gain to seller goes up. As there is still some margin on the shipments, the overall pie increases (well, it's cut out from the competitor).

- The way this campaign works is: It plays into sunk-cost fallacy "I've already paid for it, might as well use it and get value". (The main competitor already does this; which means we're only doing this defensively). So the seller diverts more of the shipments towards Vamaship.

- Pitch: Get additional discounts! Pay a small upfront fee to get a deep discount on all shipments for the month. Content: Rs 1000 subscription cost, 10% per-shipment cost decrease, NDR services are free. Good for core users. Rs 5000 subscription cost, 20% per-shipment cost decrease, NDR services & instant COD are free. Good for power users. A judgement will be done at a per-customer level before rolling out campaign.

- This will be pitched by email and calls, as usual. Frequency: Once a month. Emailer will go out at the start of the month, call - best time is during the monthly performance dashboard presentation by the account manager.

- This is a depth play; we expect the shipments per month to increase.

- Volume-based Price discounts

- This campaign is targeted at casual users. They are usually on higher pricing plans.

- This campaign works on the Ikea effect. "This product is more valuable, since I have invested effort into it and made it work for me". It works to increase frequency and depth.

- Pitch: Ship more, save more. Content: For first 5 shipments a month, they get base price. For the next 5 shipments, they get 2% discount. After hitting 25 shipments, the next shipments are at 4% discount.

- We run this campaign on an emailer, sent at the start of each month, to casual users.. While we don't directly offer a price discount, we credit the user's account. We expect the customer to use the "quick ship" feature (shipment booking by manually entering data) more often.

- This campaign can be said to have succeeded if it converts casual users into core users, and shows up in the number of shipments booked per month.

- The pricing structure is such that a customer wants to stay on volume-based price discounts up to 200 shipments a month. Then it's better to move to subscription plan - core till 1000 shipments a month. Then it's better to move to subscription plan - power. This is essential for the discounting plans to work; or else the customer would want to never move into the higher plan.

- Seasonal shipping spree / CEO connect

- This campaign is targeted at power users.

- The ecom industry comes with a lot of seasonality. During peak seasons (any festival, Aug-Oct, etc), we run a campaign. This campaign is not targeted for pricing, but rather for quality. These are times when there is a lot of stress on logistics partners; during which historically we've been the best in the industry. This is the reason why this campaign should work. This is the time to cash-in on the quality perception built over the years.

- During this campaign, we pick all the previous difficulties in shipments that the customer faced (we have a repository), and show them how we resolved it. And then we clarify that such resolution is not possible with competitors

- This is a campaign where data is presented by our CEO, to the customer's CEO. It's the definition of a depth campaign; and the focus is not on the product, but on the responsiveness.

- The goal is to see a huge spike in shipment numbers during peak seasons.

- There is no offer. This may happen thrice a year for any customer; but it happens just before their sales season.

- This campaign is targeted at core and power users, to explain why Vamaship was the right choice in hindsight. The aim here is to empower the decision maker and blocker. The decision maker would want to capture more of the benefit and shift more volumes to Vamaship; the blocker would block competitors.

Resurrection

Main reason for churn:

We have been doing this for many years: It's almost always pricing (there are numbers to back this up, though I cannot present them here). There are also a few odd cases where customers leave due to poor pickups or deliveries (it was strange back then, customers were more upset about poor pickups than poor deliveries), which is the reason we started NPR and NDR services. Interestingly, many of them come back to us for service quality (but not all do so)

The best part about the industry is that - for core & casual users - we get to know exactly why the customer left, who influenced this decision, and the genesis for the question to which the decision was taken. A VC is a powerful influencer - doesn't always exist, but the VC will almost always favour Shiprocket due to social proof, and since RTO rates are opaque - RTO rates are pretty much core to our CVP. VCs are also out of our reach, hence that's effectively voluntary churn that we cannot address.

When customers drop from power to core or core to casual users, there are a few warning signs. They stop using VAS. They reduce their shipment volumes (we measure a drop of 2 standard deviations in shipments per week as watchlist/churned customers). The logistics managers voice out discontentment to Vamaship account managers. So we're never lacking for information in this regard. As such, the campaigns are designed around the resolution, rather than gathering data.

Resurrection campaigns:

Distribution channel for churned users will always be phone calls. There are no other channels used, as the number of churning users are low enough to call them. The sales team who onboarded the customer calls them.

- Education campaign

- Persona: Customer who churn because of pricing, but like our services - and has RTO numbers to back it up (usually obtained from the influencer - the logistics manager, who is about to face the music when RTO rates go up due to shipping with the cheaper competitor)

- Campaign: When the influencer shares that shipment RTO rates are considerably different, the aim of the campaign is to arm the influencer rather than try price matching. Thankfully, there are clear numbers indicating the value impact that Vamaship brings.

- Why it will work: The true cost of logistics is not shipping cost. The true cost of logistics is shipping cost + lost sales. Lost sales is the metric where RTO rates play a huge role for COD shipments; but most players do not fully understand how to add a value to it. This serves as the foot in the door we need to retain the customer. This works on a depth basis (reduces the intensity by showing value rather than looking at price)

- Target feature: Shipment booking

- Pitch & Content: Restart shipping as we're actually the more profitable aggregator for you.

- Campaign goal: Reactivate customers; have them complete 5 shipments again.

- Offer: A reduced shipping price for the first month

- Frequency: One time

- Success metric: 5 shipments booked in the first week (not month). No need of a milestone here.

- Price discount campaign

- Persona: Customer who churned because of pricing, but like our services

- Campaign: Price discount. The price discount will stay post campaign, but it's better than losing the customer. As such, we cannot go below 10% margins. If the discounting requested makes the shipment price go below 10%, we use subscription campaign instead.

- Why it will work: We can't always match price; but even a discount can help sway the balance as the customer values the CVP. This works on a depth basis (reduces the intensity by reducing price)

- Target feature: Shipment booking

- Pitch & Content: Restart shipping, we'll give you a price discount. No strings attached

- Campaign goal: Reactivate customers; have them complete 5 shipments again.

- Offer: Price discount

- Frequency: One time

- Success metric: LTV after retention

- Milestone: 5 shipments booked in first week.

- Subscription campaign

- Persona: Customer who churned because of pricing, but like our services

- Campaign: In case the price expected by customer makes shipment margin go below 10%, then we offer a subscription based pricing

- Why it will work: A subscription would make the shipment cost go low - only if the customer provides shipment volumes. However, the customer can better experience the CVP again. This works on a depth basis (reduces the intensity by reducing price)

- Target feature: Shipment booking

- Pitch & Content: Restart shipping using a subscription, we'll give you a price discount

- Campaign goal: Reactivate customers; have them complete 5 shipments again.

- Offer: Price discount

- Frequency: One time

- Success metric: LTV after retention

- Milestone: 5 shipments booked in first week.

- Watchlisted customer

- Persona: Customer who churned because of delivery/pickup issues

- Campaign: Salesperson would put the customer on a watchlist and ensure pickup/delivery

- Why it will work:

- Customer still trusts the salesperson as they onboarded them (the trust is lost on the ops team here)

- Once a shipper is on the watchlist, we have data that suggests that the shipments are more likely to be picked up / delivered (data confidential)

- Target feature: Shipment booking

- Pitch & Content: Restart shipping, we'll put you on watchlist for a month.

- Campaign goal: Reactivate customers; have them complete 5 shipments again. Ensure delivery.

- Offer: Increased service (no monetary offer)

- Frequency: One time

- Success metric: LTV after retention

- Milestone: 5 shipments booked in first week.

- Critical shipments only

- Persona: Customer who churned because of pricing

- Campaign: Request the seller to only send stressed/critical shipments through Vamaship

- Why it will work: This is a last resort. We request the seller to continue shipping with us, but only for critical shipments where Vamaship's superior service quality can reflect.

- Target feature: Shipment booking

- Pitch & Content: Restart shipping but only for critical shipments. We excel at those.

- Campaign goal: Reactivate customers; have them complete 5 shipments again. Ensure delivery.

- Offer: Reduced pricing (20% discount)

- Frequency: One time

- Success metric: LTV after retention

- Milestone: 5 shipments booked in first week.

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.